Retirement planning is an essential step towards financial security in your golden years. As a couple, it becomes even more critical to plan for retirement together, considering that your goals...

At Accounts Tax Solution Australia, we’re dedicated to helping you take your business to new heights. Whether you’re a startup looking to establish your presence or an established company aiming for expansion, we’re here to provide expert guidance and solutions tailored to your needs.

At Accounts Tax Solution Australia, we understand that managing the financial aspects of your business can be overwhelming. That’s why we’re here to simplify the process and provide you with the expert support and guidance you need to thrive.

At Accounts Tax Solution Australia, we believe in taking a personalized approach to every client we serve. We understand that every business is unique, with its own set of challenges and opportunities. That’s why we take the time to listen to your needs, understand your goals, and tailor our services to meet your specific requirements.

I can't thank Accounts Tax Solution Australia enough for their exceptional service and support. As a small business owner, managing finances can be overwhelming, but they made the process seamless and stress-free. Their expertise in accounting and taxation helped me navigate complex regulations and optimize my finances. I highly recommend them to any business owner looking for reliable and professional financial services.

Working with Accounts Tax Solution Australia has been a game-changer for my business. Their team of experts took the time to understand my goals and challenges, and provided tailored solutions to help me achieve success. From tax planning to business consulting, their advice has been invaluable in driving growth and profitability. I'm grateful to have them as a trusted partner on my business journey.

I've been a client of Accounts Tax Solution Australia for several years now, and I couldn't be happier with their services. Their attention to detail, professionalism, and commitment to client satisfaction are second to none. Whether it's handling my bookkeeping, preparing my taxes, or providing strategic advice, they always go above and beyond to meet my needs. I highly recommend them to anyone in need of top-notch financial services.

Stay compliant with tax laws and maximize your tax efficiency with our expert tax planning and preparation services.

Gain strategic insights and advice to optimize your operations, improve profitability, and achieve sustainable growth.

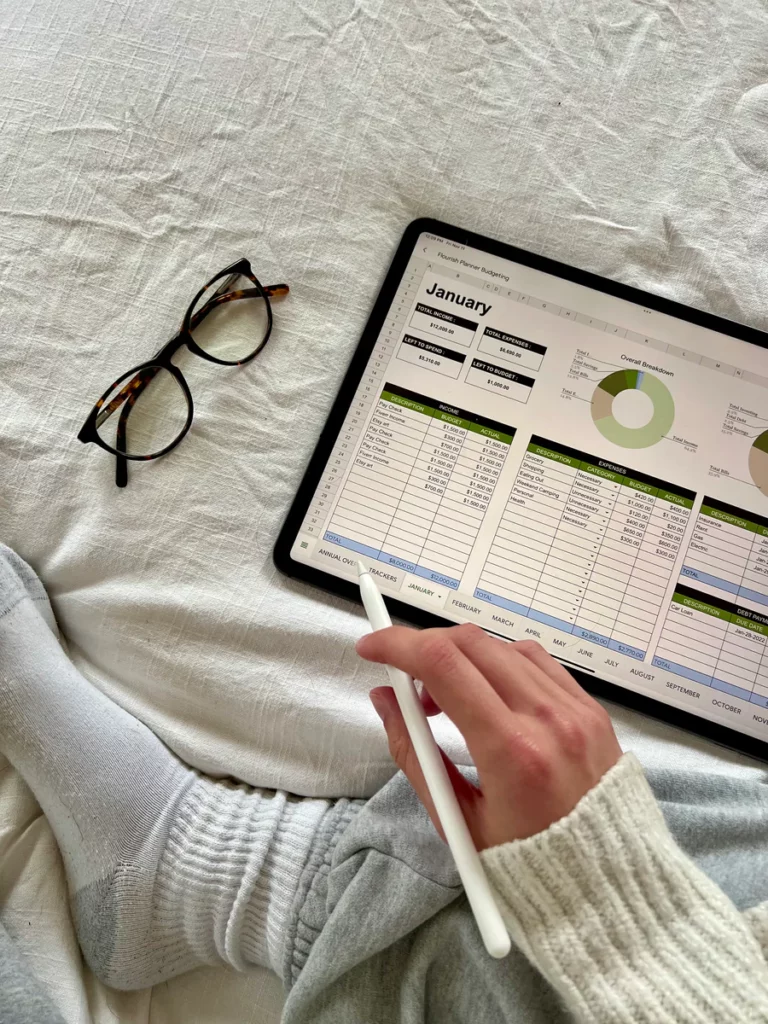

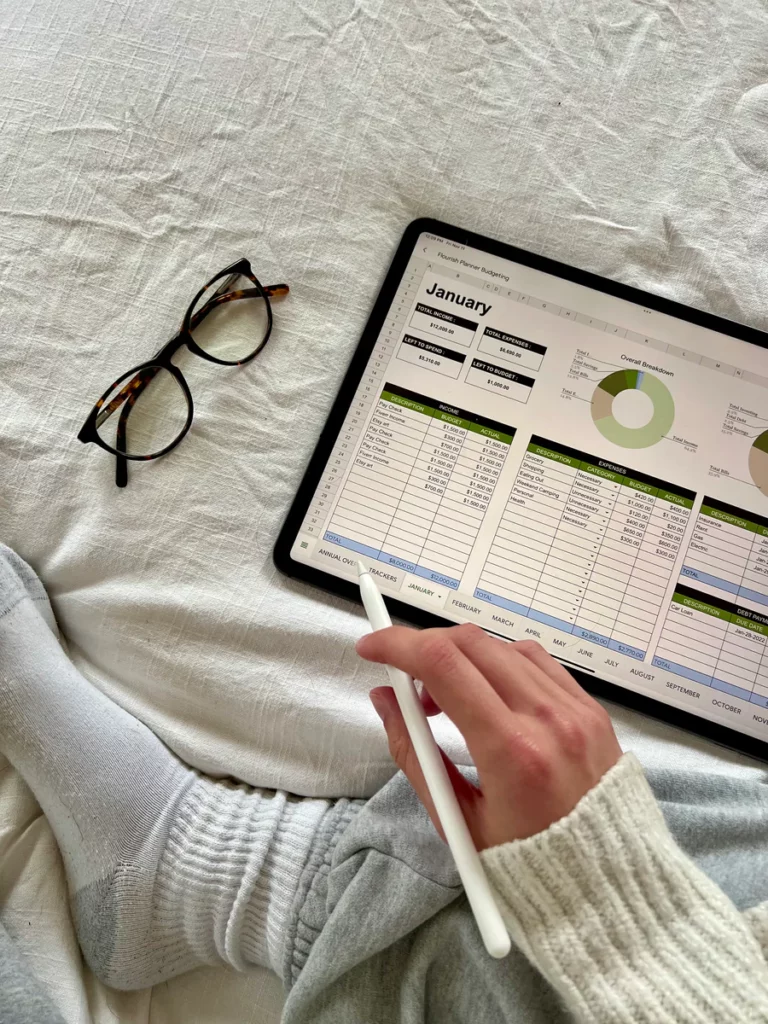

Make data-driven decisions with our comprehensive financial analysis services, designed to provide valuable insights into your business performance.

Retirement planning is an essential step towards financial security in your golden years. As a couple, it becomes even more critical to plan for retirement together, considering that your goals...

Retirement planning is an essential part of building a secure financial future. It involves making informed decisions about how much money you will need to live comfortably in retirement and...

Sydney’s financial landscape is complex and ever-evolving. To navigate this dynamic market successfully, it is crucial to gain a deep understanding of its key characteristics and major players. In this...

From day-to-day bookkeeping to financial reporting, Delta Financial Group will handle all your accounting needs so you can focus on running your business.

Our team of experienced professionals brings a wealth of knowledge in accounting, taxation, and business consulting. With our expert advice and insights, you can make informed decisions to drive your business forward.

We understand that every business is unique. That's why we take the time to understand your goals, challenges, and opportunities, and develop customized solutions to meet your specific needs.

From bookkeeping and tax compliance to business planning and advisory services, we offer a wide range of services to support your business at every stage of its growth journey.

Our track record speaks for itself. Countless businesses have achieved success with the help of Accounts Tax Solution Australia. Let us help you unlock the full potential of your business.

Experience the difference that Accounts Tax Solution Australia can make for your business.